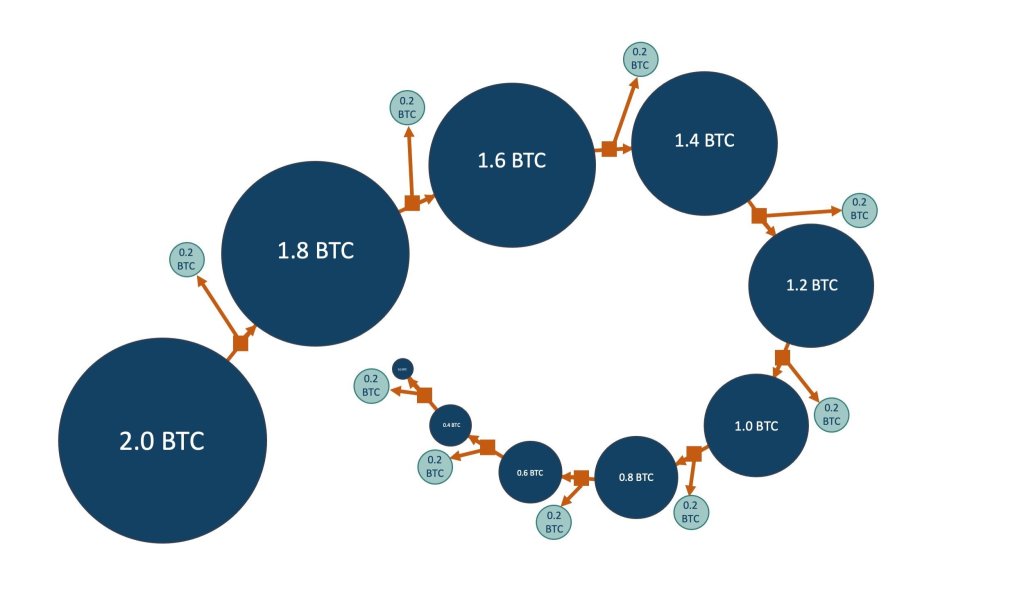

Red Flags for Chain Peeling:

A single customer receives cryptoassets at an exchange, with blockchain data indicating a large number of hops, e.g. 20 or greater, through multiple new wallets within a very short period, e.g. several hours. Implement transaction monitoring systems to identify unusual transaction patterns, including high-volume hops within a short timeframe. Investigate the source of funds and the purpose of such transactions. (The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, SI 2017/692, UK (Regulation 28).

In some cases, the cryptoassets associated with the new addresses may be deposited into numerous mule accounts. Utilize risk assessment tools to identify mule accounts and their associated activities. Establish customer due diligence (CDD) procedures and ongoing monitoring to detect and report suspicious activities. (Proceeds of Crime Act 2002, c. 29, UK (Sections 330-332).

Each individual transaction associated with the new wallets will tend to occur in a very short period of time, with all transactions part of the same block or separated by only one or two blocks. Employ advanced analytics and blockchain analysis tools to identify transactions with similar patterns and assess potential risks. Collaborate with other exchanges to share information about suspicious activities. (Directive (EU) 2018/843 of the European Parliament and of the Council of 30 May 2018 (5AMLD), Article 47.)

The activity in question may be identified very shortly after a known exchange hack or other major criminal event has occurred involving large amounts of cryptoassets. Strengthen security protocols to prevent unauthorized access and hacks. Monitor and track stolen funds and report any suspicious activities to relevant authorities. (The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, SI 2017/692, UK (Regulation 20).

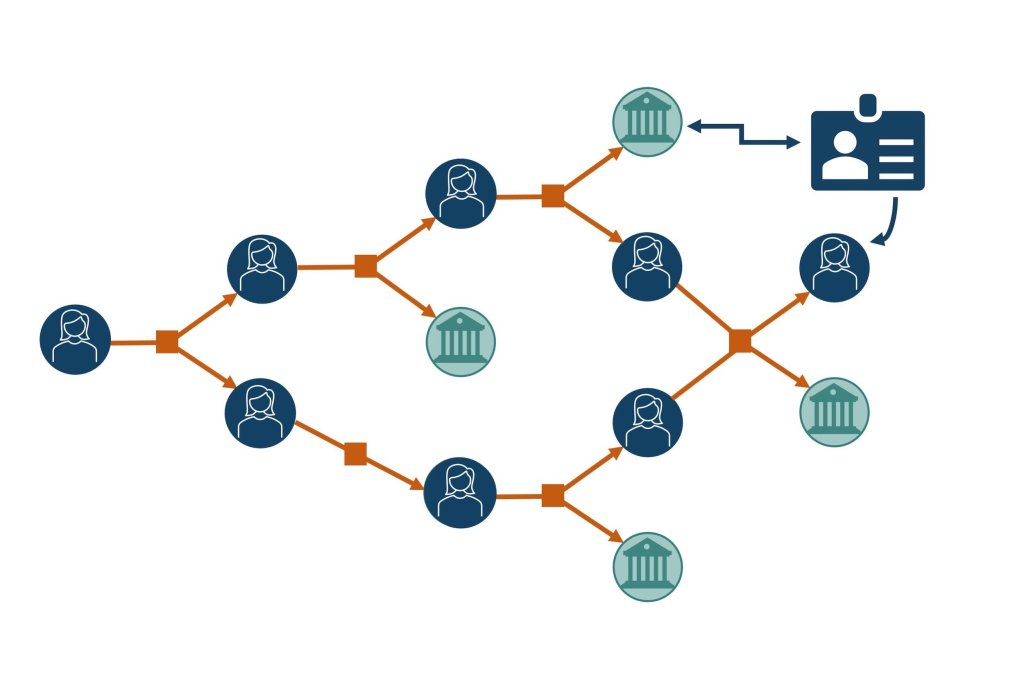

Red Flags for Multi-customer Cross-account Activity:

Multiple customers with shared addresses, mobile devices, or other common indicators create accounts simultaneously and begin sending funds on a continuous basis with volumes or values that don’t appear to have any legitimate purpose. Conduct enhanced due diligence on customers sharing common indicators, including verifying their identities and assessing the purpose of their transactions. Implement systems to detect and report suspicious activities. (Directive (EU) 2018/843 of the European Parliament and of the Council of 30 May 2018 (5AMLD), Article 18.)

A customer in one jurisdiction transfers funds to another customer in a different jurisdiction, with funds immediately cashed out at an exchange or ATM in short succession and unusual velocity. Implement transaction monitoring systems to identify high-velocity cross-jurisdiction transfers. Investigate the purpose of these transfers and assess the risk of money laundering or terrorist financing. (The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, SI 2017/692, UK (Regulation 33).

The individuals in question may have different surnames or nationalities so are unlikely to be family members. Conduct enhanced due diligence on customers with different surnames or nationalities, particularly those engaging in suspicious transactions. Verify the relationships between customers and monitor their activities. (Proceeds of Crime Act 2002, c. 29, UK (Sections 330-332).

The relevant customers are unable or unwilling to provide information about their source of funds and the purpose of their repeated transfers. Implement strict customer due diligence procedures to obtain necessary information about the source of funds and the purpose of transactions. If customers are unwilling to provide information, consider terminating their accounts and reporting suspicious activities to relevant authorities. (Directive (EU) 2018/843 of the European Parliament and of the Council of 30 May 2018 (5AMLD), Article 14.)

In conclusion, both Chain Peeling and Multi-customer Cross-account Activity red flags can be addressed through a combination of preventive measures that include transaction monitoring systems, customer due diligence procedures, risk assessment tools, advanced analytics, and blockchain analysis tools. Adherence to legal and financial guidelines provided by sources like the 5th Anti-Money Laundering Directive (5AMLD), Proceeds of Crime Act 2002 (POCA), and The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLRs) can help cryptocurrency businesses mitigate risks associated with money laundering and terrorist financing.