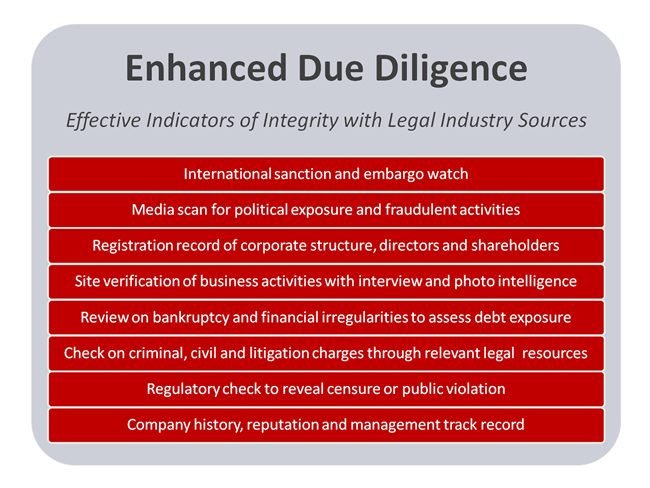

EDD (Enhanced Due Diligence) is a more in-depth form of customer due diligence required in higher-risk situations, such as when dealing with politically exposed persons (PEPs), customers from high-risk countries, or transactions that present a higher risk of money laundering or terrorist financing. EDD measures may include obtaining additional information about the customer, the source of funds, and the purpose of the transaction, as well as increased monitoring of the business relationship (Citation: UK Money Laundering Regulations 2017 (MLR 2017) – Regulation 33).

- Customers with known PEP (Politically Exposed Person) status or connections. Implement enhanced due diligence measures for PEPs, including obtaining senior management approval, identifying the source of funds, and conducting ongoing monitoring (JMLSG Guidance, Part 1, Section 5.5.7).

- Transactions with no apparent economic or legal purpose or transactions that are overly complex. Conduct enhanced scrutiny and document findings, including the background and purpose of such transactions (FATF Recommendation 10, Interpretive Note to Recommendation 10, Paragraph 21).

- Sudden increase in transaction volume or frequency without a clear explanation. Perform enhanced due diligence and ongoing monitoring to determine the reason for the change in activity (FATF Recommendation 10, Interpretive Note to Recommendation 10, Paragraph 19).

- Customers or transactions involving shell companies. Require identification and verification of beneficial owners, and conduct enhanced due diligence for higher risk situations (FATF Guidance on Transparency and Beneficial Ownership, Section 3.3).

- Transactions with mixing services or privacy coins. Apply enhanced due diligence measures and develop risk mitigation policies for the use of privacy coins or mixing services (5AMLD – Article 47, and UK Money Laundering Regulations 2017 (MLR 2017) – Regulation 28(12)).

- Rapid and frequent transactions between multiple wallets without a clear purpose. Conduct transaction monitoring and enhanced due diligence on unusual transaction patterns (Joint Money Laundering Steering Group (JMLSG) Guidance, Part 1 – Section 5.3.7).

- Transactions linked to darknet marketplaces or illegal goods and services. Implement ongoing monitoring and report any suspicious activities to the relevant authorities (Proceeds of Crime Act 2002 (POCA) – Section 328).

- Transactions involving known or suspected criminal addresses, such as those published on the Office of Foreign Assets Control (OFAC) sanctions lists or UK sanctions lists. Conduct regular sanctions screening and report any matches to the relevant authorities (UK Sanctions and Anti-Money Laundering Act 2018 – Section 54).

- Use of VPNs, TOR, or other tools to mask IP addresses. Implement risk-based procedures to identify and manage higher risk customers or transactions, including enhanced due diligence (JMLSG Guidance, Part 1 – Section 5.3.72).

- Transacting with entities operating in high-risk jurisdictions or customers from high-risk countries. Apply enhanced due diligence and risk mitigation measures for customers and transactions with high-risk jurisdictions, including obtaining additional information and conducting ongoing monitoring (JMLSG Guidance, Part 1 – Section 4.6).

| EDD Risks | Preventative Measures | Citation of Authority |

| Anonymity associated with Virtual Assets (VAs): The pseudonymous nature of VAs can pose a significant risk as it may enable individuals to engage in financial transactions while hiding their identity. | Implement robust Know Your Customer (KYC) and Customer Identification Program (CIP) procedures. Use blockchain forensic tools to analyze transactions and identify associated risks. | FATF Guidance for a Risk-Based Approach to Virtual Assets and VASPs (2019) |

| Lack of regulatory oversight: Some jurisdictions may lack comprehensive regulations for VAs, leading to a higher risk of money laundering (ML) and terrorist financing (TF). | Understand and comply with regulations in all jurisdictions where the business operates. Implement a strong compliance program and engage a compliance officer. | The Wolfsberg Group’s Statement on Cryptocurrency Due Diligence (2019) |

| Peer-to-Peer (P2P) Exchange Risks: P2P transactions can bypass regulatory oversight and pose significant ML/TF risks. | Monitor and report suspicious activities. Implement transaction limits for P2P exchanges. | Chainalysis (2021) Crypto Crime Trends for 2021 |

| Decentralized Finance (DeFi) Risks: DeFi platforms can be exploited for illicit activities due to their open and permissionless nature. | Monitor DeFi-related transactions closely. Use blockchain analytic tools to identify suspicious activities. | Chainalysis (2021) Crypto Crime Trends for 2021 |

| Use of privacy coins: Privacy coins can make transactions untraceable, increasing the risk of ML/TF. | Implement policies to restrict or carefully monitor transactions involving privacy coins. | The Blockchain Transparency Institute’s Crypto Anti-Money Laundering Report (2020) |

| Cross-border transactions: The global nature of VAs can complicate the detection and prevention of illicit activities. | Ensure compliance with the laws of all involved jurisdictions. Use a risk-based approach for cross-border transactions. | FATF Guidance for a Risk-Based Approach to Virtual Assets and VASPs (2019) |

| Rapid technological changes: The fast-paced evolution of VA technologies can pose new risks and challenges. | Continuous training and education for staff. Regular updates to risk assessment and mitigation strategies. | The Cambridge Centre for Alternative Finance’s Global Cryptoasset Regulatory Landscape Study (2020) |